The Best Guide To Federated Funding Partners Legit

Table of ContentsThe Only Guide for Federated Funding Partners ReviewsHow Federated Funding Partners Reviews can Save You Time, Stress, and Money.Federated Funding Partners Bbb - The FactsFederated Funding Partners for BeginnersFederated Funding Partners Reviews for BeginnersGetting The Federated Funding Partners Bbb To Work

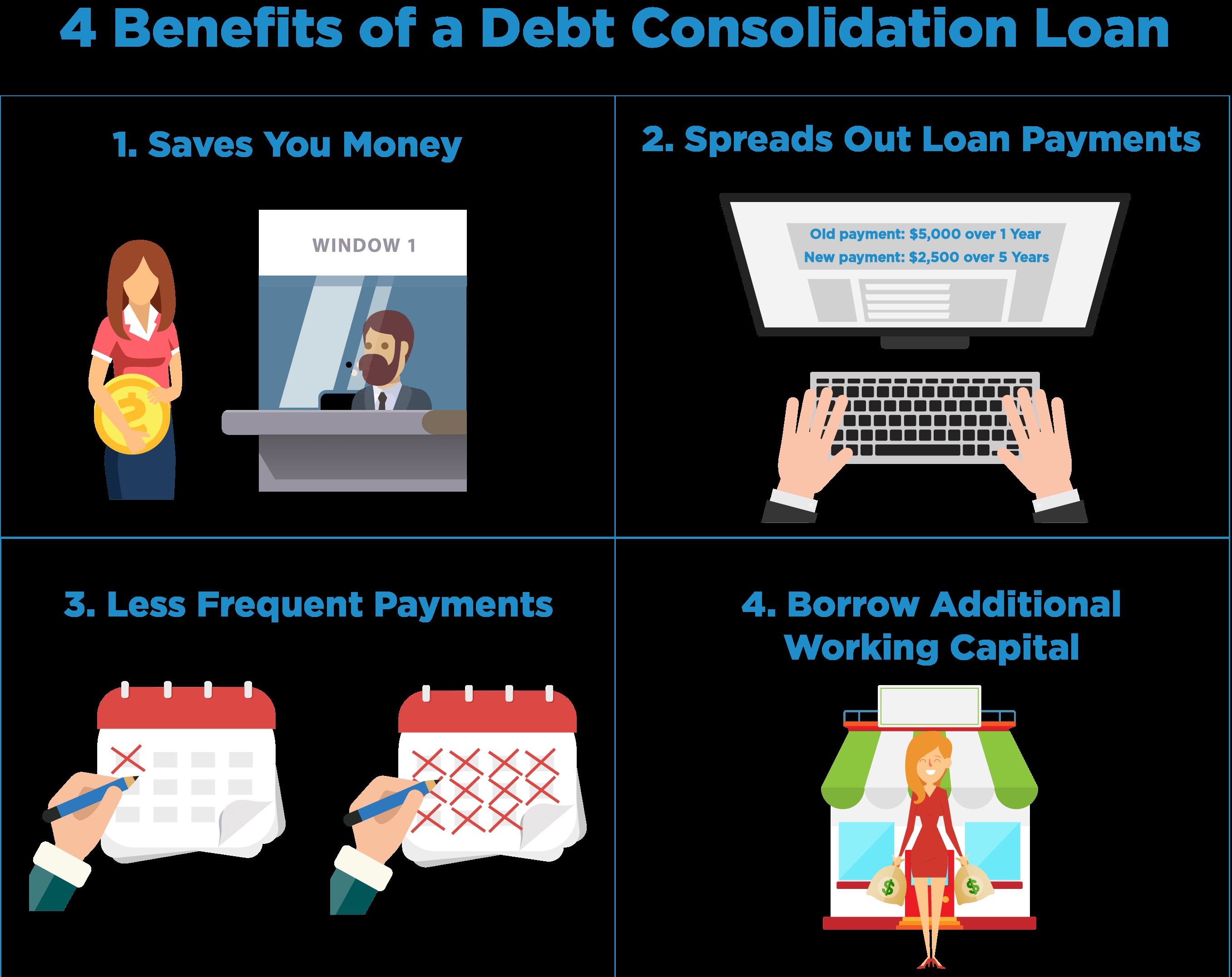

Here's what you need to recognize concerning financial debt consolidation: What are the benefits of financial obligation consolidation? Long-lasting financial obligation with a high rate of interest rate can set you back thousands of bucks in rate of interest payments over the life of the car loan.With simply one month-to-month payment to make, handling your debt will certainly be a whole lot less complicated. Financial obligation debt consolidation typically means having a set payment timeline.

If you have actually been falling back on your monthly repayments, moving your multiple financial debts to a single low-interest loan can assist to boost your score. What are the negative aspects of financial obligation consolidation? May extend the payment timeline of the debt. Relocating debt to a new funding can sometimes include extending the term of the loan.

10 Easy Facts About Federated Funding Partners Reviews Described

If overspending as well as untrustworthy cash administration is what landed the borrower in debt in the very first area, combining financial obligation on its own will certainly not resolve the problem. Several reduced- or no-interest credit history cards only offer these attributes as a momentary promotion.

Just how can I combine my financial obligation? You have several alternatives for financial debt combination, each with its own pros and also disadvantages. Personal Funding or Line Of Credit (PLOC): Getting an unsecured financing from Abilene Educators FCU will enable you to settle all your outstanding car loans right away and also move your debts right into one low-interest loan (federated funding partners).

Lucky for you, though, as a member of Abilene Teachers FCU you have access to personal loans or personal lines of credit scores with no origination charges and also interest rates as low as 7. House Equity Loan (HEL): A home equity lending utilizes your residence as collateral for a fixed-term funding.

Federated Funding Partners Can Be Fun For Anyone

As safeguarded financial debt, passion on HELs will certainly be economical and might supply you with considerable financial savings. Passion on residence equity car loan products is usually tax-deductible.

You may simply intend to consolidate your different credit lines. Rather than attempting to master all those numbers in your head or producing a legendary spreadsheet, you may simply intend to settle your various lines of credit scores. Financial debt debt consolidation is when you combine existing financial obligations into a brand-new, solitary funding.

What Is Financial debt Consolidation? It's when you take out one finance or line of credit scores and also use it to pay off your numerous debtswhether that's pupil lendings, auto fundings, or credit history card financial debt.

Federated Funding Partners Bbb for Dummies

Credit alleviation programs can assist you consolidate your financial obligation, yet they aren't getting you a brand-new loanit's only consolidation. Applying For a Debt Debt consolidation Funding When choosing a financial debt consolidation funding, look for one that has an interest rate and terms that fit right into your general financial image.

The Only Guide to Federated Funding Partners Bbb

With safeguarded financings, you utilize an asset like a house or automobile to guarantee the finance. If something occurs as well as you can not settle the loan, after that the financial institution can take the property that is functioning as collateral. An unsecured debt loan consolidation loan can help you prevent placing other possessions on the line.

This is due to the fact that individuals can save a significant quantity by consolidating their high passion credit report card financial obligation with a new lower-interest funding. There are many banks, credit history unions, and online lending institutions who use finances for consolidating debt.

Generally, individuals looking for financial debt combination lendings have numerous sources Going Here of financial debt and also wish to achieve 2 points: First, lower their rate of interest rateand consequently pay much less read here each monthand reduce the amount they need to pay over the life of their financing. Second, they are trying to combine multiple fundings into one, making it easier to track monthly payments.

Federated Funding Partners Bbb for Beginners

36 in rate of interest. But if you settle that debt with a brand-new funding that has an 8% passion rate as well as a 10-year term, you visit the site will pay $4,559. 31 in rate of interest. Not just would you save cash in passion by combining your credit report card financial debt, however you can potentially improve your debt score by paying back your combined car loan on time.